Going through a divorce is one of life’s most challenging experiences, and when you’re a business owner, the stakes feel even higher. The thought of losing the company you’ve built from the ground up can be overwhelming. If you’re facing divorce in Dallas, Texas, understanding how to protect your business interests is crucial for your financial future and peace of mind.

As a business owner contemplating divorce, you’re not alone in your concerns. Many successful entrepreneurs and professionals worry about how their business will be affected during divorce proceedings. The good news is that with proper planning, strategic legal guidance, and understanding of Texas law, you can navigate this difficult time while protecting your business interests.

Understanding Texas Community Property Laws and Business Assets

Texas operates under community property laws, which means that assets acquired during marriage are generally considered jointly owned by both spouses. This principle can significantly impact how your business is valued and divided during divorce proceedings.

The classification of your business as separate or community property depends on several factors, including when it was established, how it was funded, and what role (if any) your spouse played in its operation. A business started before marriage may be considered separate property, while one established during the marriage typically falls under community property classification.

However, the reality is often more complex. Even if your business was established before marriage, if marital funds were used to grow the business or if your spouse contributed to its success, portions of the business value may be subject to division. This is where working with an experienced Dallas divorce lawyer becomes essential.

Business Valuation Methods in Texas Divorce Cases

Asset-Based Valuation Approach

The asset-based approach examines your business’s tangible and intangible assets, subtracting liabilities to determine net worth. This method works well for businesses with significant physical assets but may undervalue companies whose primary worth lies in intellectual property, customer relationships, or brand recognition.

Income-Based Valuation Approach

This method focuses on your business’s earning potential, using historical financial data and projected future earnings to determine value. Financial experts often use the capitalization of earnings method or discounted cash flow analysis to arrive at a fair market value.

Market-Based Valuation Approach

The market approach compares your business to similar companies that have recently sold or are publicly traded. While this method can provide valuable insights, finding truly comparable businesses can be challenging, especially for unique or specialized companies.

Strategies for Protecting Your Business During Divorce

Pre-Divorce Planning and Documentation

Thorough documentation is your first line of defense. Gather all business records, including financial statements, tax returns, contracts, and operational agreements. Organize these documents chronologically and ensure they clearly demonstrate the business’s separate property origins if applicable.

Consider engaging a forensic accountant early in the process. These professionals can help trace the source of business funding, identify any commingling of marital and separate property, and provide expert testimony if needed during proceedings.

Negotiation Strategies for Business Division

Not all divorce cases require lengthy court battles. Many business owners find success through strategic negotiation, which can preserve business operations while achieving fair division of assets. Common negotiation strategies include:

Buyout Arrangements: You may choose to buy out your spouse’s interest in the business, either through a lump sum payment or structured payments over time. This option allows you to maintain full control while compensating your spouse for their community property interest.

Asset Offsetting: Rather than dividing the business itself, you might negotiate to keep the business while your spouse receives other marital assets of equivalent value, such as the family home, retirement accounts, or investment properties.

Continued Co-Ownership: In some cases, divorcing spouses successfully maintain business partnerships. This arrangement requires clear agreements about decision-making authority, profit distribution, and exit strategies.

Working with a skilled Dallas family law attorney who understands business valuation and division can help you explore these options and determine the best strategy for your situation.

Key Factors Affecting Business Valuation in Texas

Timing of Business Establishment

The timing of when your business was established plays a crucial role in determining how it will be classified and valued. Businesses established before marriage with separate property funds may have stronger protection, while those started during marriage face more complex valuation challenges.

Spouse’s Role in Business Operations

Courts carefully examine whether your spouse contributed to the business’s success. This contribution doesn’t necessarily mean direct employment; it could include supporting roles that allowed you to focus on business growth, networking efforts, or even indirect contributions through household management that freed up your time for business activities.

Use of Marital Funds for Business Growth

If marital income was used to grow or maintain the business, courts may consider portions of the business’s increased value as community property. This situation requires careful analysis to determine what portion of the business growth is attributable to separate versus community property investment.

Business Growth During Marriage

Even if your business was established with separate property, significant growth during marriage may be subject to division. Courts often examine whether this growth resulted from your personal efforts (which may be considered community property) or from passive appreciation of the separate property asset.

Protecting Your Business: Proactive Measures

Prenuptial and Postnuptial Agreements

The most effective way to protect your business is through a well-drafted prenuptial or postnuptial agreement. These documents can clearly define your business as separate property and outline how it will be handled in the event of divorce.

A comprehensive agreement should address business ownership, management rights, valuation methods, and restrictions on spouse involvement. It should also consider future business growth and how that growth will be classified.

Business Structure Considerations

The way your business is structured can impact its protection during divorce. Consider whether your current structure (sole proprietorship, LLC, corporation) offers adequate protection and whether restructuring might be beneficial.

Some business owners establish family limited partnerships or create buy-sell agreements that restrict ownership transfers. These structures can provide additional layers of protection while offering tax benefits and succession planning advantages.

Keeping Business and Personal Finances Separate

Maintaining clear separation between business and personal finances is crucial. Avoid using business accounts for personal expenses and refrain from depositing personal funds into business accounts. This separation helps establish clear boundaries and supports arguments for separate property classification.

Common Mistakes to Avoid When Protecting Your Business

Attempting to Hide Assets

Never attempt to hide business assets or undervalue your business. Courts take a dim view of dishonesty, and getting caught can result in severe penalties and unfavorable rulings. Transparency and honesty, while difficult, ultimately serve your best interests.

Failing to Gather Proper Documentation

Incomplete or disorganized documentation can weaken your position significantly. Start gathering records early and work with professionals who understand what documentation is needed for your specific situation.

Making Hasty Business Decisions

Avoid making significant business changes during divorce proceedings without consulting your attorney. Changes like selling assets, taking on partners, or restructuring operations can have unintended consequences for your divorce case.

Not Considering Tax Implications

Business division decisions can have significant tax consequences. Work with tax professionals to understand how different division scenarios will affect your tax liability and overall financial position.

Working with Professional Advisors

Choosing the Right Legal Team

Select a Dallas divorce lawyer with specific experience in business valuation and high-net-worth divorce cases. Your attorney should understand both family law and business law principles and have relationships with qualified valuation experts.

Look for attorneys who offer personalized attention and transparent pricing. The stress of divorce is significant enough without worrying about unexpected legal fees or feeling like just another case number.

The Role of Business Valuation Experts

Professional business valuators bring objectivity and expertise to the process. They understand various valuation methods, can identify factors that affect business worth, and provide credible expert testimony if your case goes to trial.

Choose valuators with experience in your industry and credentials such as Certified Business Appraiser (CBA) or Accredited Senior Appraiser (ASA) designations.

Financial Planning Considerations

Work with financial planners who understand the unique challenges of divorce. They can help you model different scenarios, understand cash flow implications of various settlement options, and plan for your post-divorce financial future.

Alternative Dispute Resolution Options

Mediation for Business Division

Mediation services can be particularly effective for business owners who want to maintain control over the division process. Mediation allows you to work collaboratively with your spouse to find creative solutions that might not be available through traditional litigation.

The confidential nature of mediation can be especially valuable for business owners who want to avoid public disclosure of sensitive business information. Additionally, mediation often costs less than litigation and can be completed more quickly.

Collaborative Divorce Processes

Collaborative divorce involves both parties working with their respective attorneys and other professionals to reach a mutually acceptable agreement. This process can be ideal for business owners who want to preserve ongoing business relationships or who have complex business structures that require creative solutions.

Specific Considerations for Different Business Types

Professional Practices

Doctors, lawyers, accountants, and other professionals face unique challenges in business valuation. Professional practices often have significant goodwill value tied to the professional’s personal reputation and relationships. These businesses may also have restrictions on ownership transfer that affect valuation.

Technology and Intellectual Property Businesses

Businesses built around intellectual property, software, or technology often have substantial intangible value that can be difficult to quantify. These businesses may also have rapid growth potential that affects valuation calculations.

Family-Owned Businesses

When family members are involved in the business, divorce can create complex dynamics. Consider how divorce might affect relationships with family members who are also business partners or employees.

Franchise Operations

Franchise businesses have unique valuation considerations, including franchise agreements, territorial rights, and ongoing royalty obligations. These factors can significantly impact both valuation and division options.

Post-Divorce Business Management

Maintaining Business Operations During Proceedings

Develop strategies to maintain business operations during divorce proceedings. This might include establishing temporary management agreements, ensuring key employees remain committed to the business, and maintaining customer relationships.

Planning for Future Growth

Consider how your post-divorce business structure will support future growth. This might involve restructuring ownership, updating business plans, or establishing new financing arrangements.

Protecting Against Future Claims

Ensure your divorce decree includes clear language about future business claims and obligations. This protection can prevent future disputes and provide clarity about ongoing financial responsibilities.

Red Flags to Avoid When Choosing Legal Representation

When selecting a Dallas divorce lawyer for your business protection needs, avoid attorneys who:

- Lack business law experience – Your case requires understanding of both family law and business principles

- Promise unrealistic outcomes – Honest attorneys will discuss both strengths and weaknesses of your case

- Use high-pressure tactics – You need time to make informed decisions about your business and future

- Provide vague fee structures – Transparent pricing helps you budget for legal expenses

- Show poor communication skills – Regular updates and clear explanations are essential

- Have overwhelmed caseloads – Your complex business issues require adequate attention and time

Decision-Making Checklist for Business Owners

Before moving forward with divorce proceedings, consider these essential factors:

Business Documentation:

- [ ] Gather all business formation documents

- [ ] Collect financial records for the past 5 years

- [ ] Organize contracts and agreements

- [ ] Document separate property contributions

- [ ] Prepare employee and customer lists

Financial Preparation:

- [ ] Obtain preliminary business valuation

- [ ] Analyze cash flow for potential buyout scenarios

- [ ] Review tax implications of different division options

- [ ] Consider financing options for spouse buyout

- [ ] Evaluate insurance needs and coverage

Legal Strategy:

- [ ] Consult with experienced Dallas divorce lawyer

- [ ] Consider mediation or collaborative divorce options

- [ ] Evaluate prenuptial or postnuptial agreement validity

- [ ] Assess strength of separate property claims

- [ ] Plan for business operation continuity during proceedings

Professional Team Assembly:

- [ ] Identify qualified business valuation expert

- [ ] Consult with tax advisor

- [ ] Engage financial planner

- [ ] Consider forensic accountant if needed

- [ ] Maintain communication with business advisors

Frequently Asked Questions

Q: How long does business valuation typically take in a Texas divorce?

A: Business valuation usually takes 2-4 months, depending on the complexity of your business and availability of financial records. Complex businesses with multiple locations or significant intangible assets may require longer evaluation periods.

Q: Can I continue operating my business during divorce proceedings?

A: Yes, you can typically continue operating your business during divorce proceedings. However, you may need to obtain court approval for significant business decisions or changes to ensure you don’t diminish the business value.

Q: What if my spouse has never been involved in the business?

A: Even if your spouse wasn’t directly involved in business operations, they may still have community property rights if the business grew during marriage or if marital funds were used to support the business.

Q: How much does business valuation cost in a divorce?

A: Business valuation costs typically range from $5,000 to $25,000, depending on business complexity. While this seems expensive, proper valuation can save you significantly more in the long run by ensuring fair division.

Q: Can I use business debt to offset my spouse’s interest?

A: Yes, business debts and liabilities are considered when determining net business value. However, you’ll need to demonstrate that debts are legitimate business obligations rather than personal debts.

Q: What happens if we can’t agree on business value?

A: If you can’t agree on business value, the court may order an independent valuation or allow each party to present their own valuation expert. The judge will then determine the appropriate value based on the evidence presented.

Q: Are there tax implications when dividing business assets?

A: Yes, business division can have significant tax implications, including capital gains taxes, depreciation recapture, and potential loss of tax benefits. Always consult with tax professionals before finalizing any division agreements.

Q: How can I finance a spouse buyout?

A: Common financing options include business cash flow, personal assets, refinancing business debt, or structured payments over time. Your attorney and financial advisor can help you evaluate the best options for your situation.

Taking the Next Step: Protecting Your Business and Your Future

Protecting your business during divorce requires careful planning, strategic thinking, and the right professional guidance. While the process can seem overwhelming, remember that thousands of business owners have successfully navigated divorce while preserving their business interests.

The key to success lies in taking action early, gathering proper documentation, and working with experienced professionals who understand both the legal and business aspects of your situation. With 25+ years of experience helping Dallas business owners protect their interests during divorce, we understand the unique challenges you face.

Don’t let uncertainty about your business future add to the stress of divorce. Whether you’re dealing with a contested divorce in Dallas, need guidance on asset division, or want to explore mediation options, we’re here to provide the personalized attention and strategic guidance you need.

Every business owner’s situation is unique, and cookie-cutter approaches simply don’t work when your livelihood and financial future are at stake. We take the time to understand your specific business, your goals, and your concerns, then develop a customized strategy designed to protect your interests while working toward a fair resolution.

Our approach combines compassionate understanding of what you’re going through with strategic legal expertise and, when necessary, tough advocacy in court. We believe in transparent pricing so you can make informed decisions about your legal representation without worrying about surprise fees.

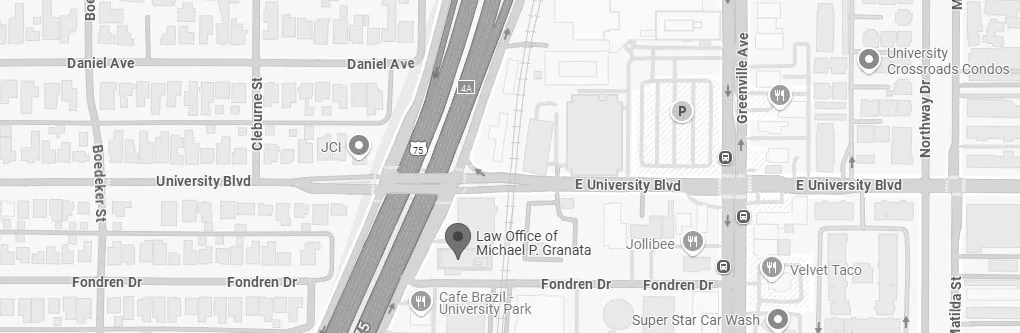

Ready to take the first step in protecting your business? Contact us today to schedule your confidential consultation. During this meeting, we’ll discuss your specific situation, explain your options, and help you understand what to expect throughout the process.

Your business represents years of hard work, dedication, and dreams for the future. Don’t let divorce uncertainty jeopardize everything you’ve built. Call us today and take the first step toward protecting your business and securing your financial future.

For more information about our services and approach, visit our Dallas divorce lawyer services page or read more articles on our blog for additional insights into Texas divorce law and business protection strategies.

Remember, you don’t have to navigate this challenging time alone. With the right legal guidance and strategic planning, you can protect your business interests while moving forward to the next chapter of your life with confidence and peace of mind.